Chapter Two: The Current Road Bumps

In this chapter summary, we'll explore the key insights from Chapter Two of the survey results ebook "2023 State of Automation in the Finance Report: Full Throttle for Finance Automation.” The current road bumps faced by finance professionals are numerous but by embracing automation, teams transform their day-to-day activities for the better.

The Need for Automation in Finance

Finance professionals have always had a long to-do list, and outdated or inadequate technology infrastructure impede the efficiency of data-related processes. Legacy systems, once considered reliable, may lack automation capabilities or integration with other systems, leading to manual workarounds and inefficiencies.

Ignoring the call for automation raises a caution flag for the finance industry. In today's technological landscape, not embracing automation could lead to crashes and other obstacles for those unwilling to invest in the future of finance.

Legacy systems, once considered reliable, may lack automation capabilities or integration with other systems, leading to manual workarounds and inefficiencies.

Top Challenges in Finance

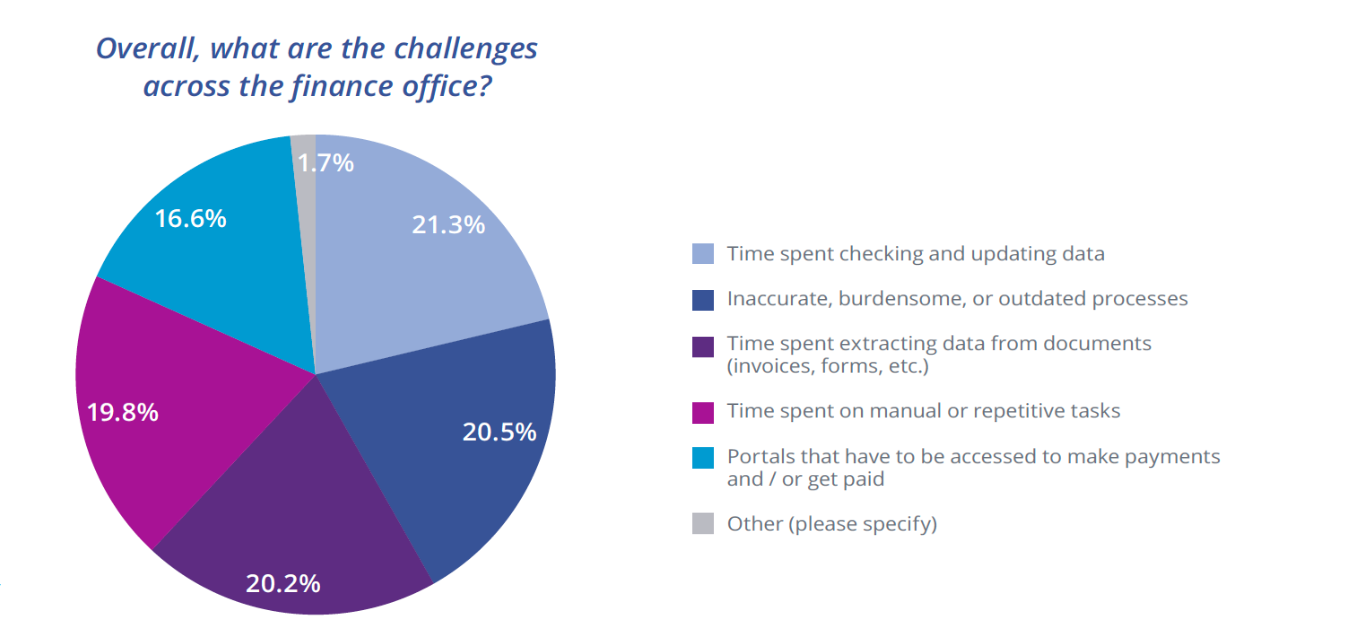

The 2023 State of Automation Report identifies the four major challenges faced by finance offices:

- Time spent checking and updating data (21.3%)

- Inaccurate, burdensome, or outdated processes (20.5%)

- Time spent extracting data from documents (20.2%)

- Time spent on manual or repetitive tasks (19.8%)

These findings highlight significant efficiency issues in data management within finance offices. Outdated processes indicate a need for digitization to streamline workflows, while manual tasks consume valuable time that could be better utilized elsewhere.

Current Pain Points for Finance Professionals

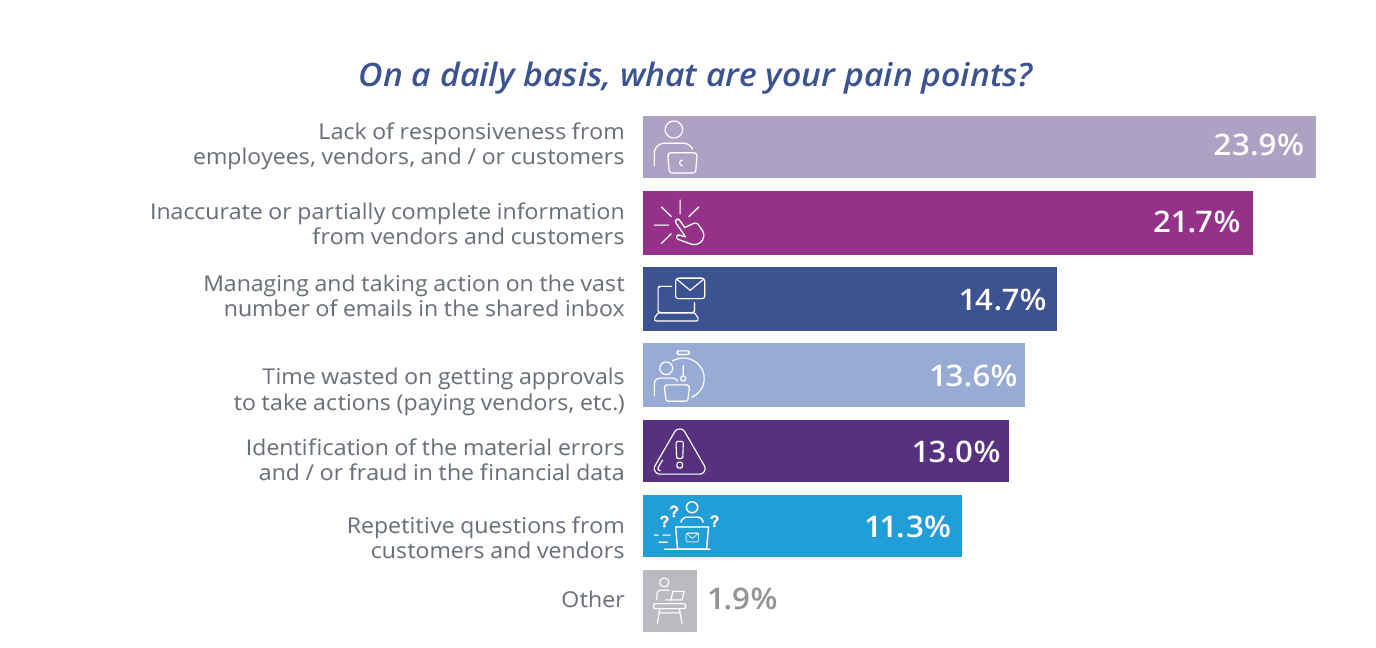

Finance professionals face three significant pain points on a daily basis:

- Lack of responsiveness from employees, vendors, and/or customers (23.9%)

- Inaccurate or partially complete information from vendors and customers (21.7%)

- Managing and taking action on the vast number of emails in the shared inbox (14.7%)

These pain points underscore the communication and information management challenges within finance offices. Incomplete information and unresponsiveness from stakeholders hinder smooth operations and project completion. Additionally, managing a high volume of emails consumes time that could be better spent on other tasks.

Manual Work and Time-Consuming Activities

A significant portion of finance professionals' work is manual, with accounts payable (34.6%) and accounts receivable (22.2%) taking the lead. Manual tasks often involve repetitive work, leading to slow turnaround times and potential errors.

Analyzing and gathering data for reports, as well as reviewing communication in the finance email inbox, are also time-consuming activities that impact productivity.

Manual tasks often involve repetitive work, leading to slow turnaround times and potential errors.

Accelerating Finance with Automation

To overcome these road bumps and improve finance operations, automation is the key. Embracing automation solutions streamlines data management, eliminates burdensome processes, and reduces time spent on manual tasks.

By leaving legacy technology behind and shifting towards automation, finance teams accelerate their productivity and focus on strategic analysis and building strong relationships with stakeholders.

In today's data-driven and fast-paced business environment, relying solely on manual processes becomes impractical and inefficient. By adopting automation, finance professionals navigate the challenges ahead with confidence and embrace a brighter, more efficient future.

The road to success in finance lies in adopting automation solutions that address challenges and pave the way for increased efficiency. Embracing automation is essential for modern finance teams to stay competitive and drive growth.

By leaving manual work behind and shifting towards automated processes, finance professionals can zoom past road bumps, leaving them free to focus on what truly matters: strategic analysis and building valuable connections with stakeholders.

It's time for finance to put the pedal to the metal with automation and accelerate towards a brighter future.

Read more in our 2023 State of Automation in the Finance Office report: Full Throttle for Finance.