FinOps Automation: It's Time

Finance and Accounting departments have a scaling problem. Engineering, Product, and Operations often have economies of scale, network effects, and operating leverage. Sales and Marketing benefit from growing brand awareness, category leadership, and expanded distribution. Thus, as companies mature, you usually see these departmental expenses decline as a percentage of revenue.

Finance and Accounting departments have a scaling problem. Engineering, Product, and Operations often have economies of scale, network effects, and operating leverage. Sales and Marketing benefit from growing brand awareness, category leadership, and expanded distribution. Thus, as companies mature, you usually see these departmental expenses decline as a percentage of revenue.

Finance and Accounting, however, can often exhibit diseconomies of scale, becoming more complicated and costly as more customers need to be “known” and collected from, more suppliers need to be vetted and paid, more complex payrolls calculated, taxes filed across innumerable jurisdictions, more regulations adhered to, more internal and external reports generated, and so on. The net result is finance teams having to expand linearly with revenue growth, often with contingent workers, making company-specific knowledge harder to transfer and recapture.

And… lots of late nights and burnt out finance employees.

So why has technology not solved this problem? We’ve had ERP software for nearly 40 years, and for the past decade, we’ve had some truly terrific cloud-native innovators like Intacct, NetSuite, and Workday. The problem is that, though these Systems Of Record are great at storing data and doing calculations, there are still myriad financial processes that require person-to-person communication, as well as human judgment and exception handling.

For example, “sorry we are late on our payment, but I have a question on the latest invoice you sent”; “thanks for responding to our request for an updated IRS W-9, but it appears that there may be a typo in your EIN”; and “this invoice seems to have missed a volume discount specified in our MSA.”

It turns out that it takes a lot of email and spreadsheets to run a modern ERP.

The above examples are not particularly challenging for a human to handle individually (the problem is the volume), but quite difficult for computers to automate given the unstructured data sources and natural language involved. Until very recently, AI/ML was simply not accurate enough to solve the problem effectively. This is especially true when trying to convince hard-nosed CFOs, skeptical and conservative by nature, who are often more willing to spend on other departments than their own.

Fortunately, advances in natural language understanding and machine learning over the past few years have crossed a similar threshold to computer vision and speech recognition in that they are now robust enough for vital operations, especially when combined with thoughtful humans-in-the-loop to handle escalations and exceptions.

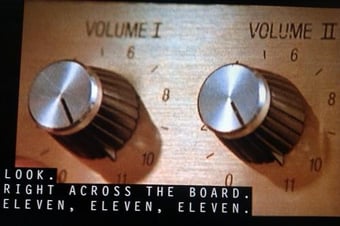

The COVID-19 pandemic has served as a catalyst for financial operations automation as office closures challenged business continuity, raised security and compliance concerns (the thought of payables being processed on an insecure home network is enough to keep any CFO up at night), and made hiring and training entry-level headcount that much harder. Lastly, the SaaS revolution, which was already in high gear before the pandemic, has now “gone to 11”, which means that Finance and Accounting must automate to keep up with the rest of the digital enterprise.

Amidst this backdrop, Venrock is thrilled to have led Auditoria.AI’s Series A funding round. We think their focus on growing mid-market businesses is spot on, given that these businesses are large enough to feel the pinch of complexity and high transaction volumes, but not resource-rich enough to have built custom solutions or require their business partners to adopt specialized means of interaction.

We love Auditoria’s breadth of vision and product approach centered around discrete SmartFlow Skills, which have already been certified by the top cloud ERP vendors. Additionally, leading mid-market accounting and audit firms, including RSM and Armanino, have already committed to supporting Auditoria’s efforts in their ERP installed bases.

But most of all, we are enamored with this team. Finance and accounting requires specialized knowledge, which relatively few technologists possess, but the Auditoria team is comprised of highly experienced alumni of Oracle, NetSuite, Intacct, and Intuit, who have successfully scaled products and startups in the past. They are also really good people, committed to enriching F&A roles by automating the drudgery, thus saving time for humans to tackle the more interesting and fulfilling work.

Auditoria is pioneering FinOps Automation, and we are grateful to be their partners for the journey.