Blog | AI In Finance

Tipping Point: The State of Automation in the Back Office

It’s here, and the results are compelling. After collaborating with more than 600 finance professionals over the last few months, today, Auditoria released its annual State of Automation in the Back Office Report for 2021.

What made this report particularly interesting was that last year, we worked with finance professionals right as the pandemic was beginning. And this year, as we commenced our research and survey efforts, the pandemic was receding in our country, and the nature of how work was delivered had changed forever.

So let’s dig in and review some of our key findings:

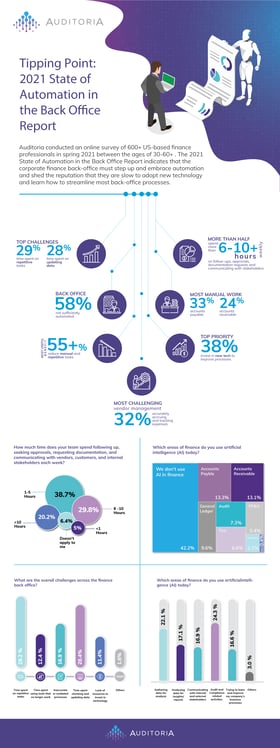

- We found that Two in Three Finance Executives felt that their back-office had inadequate or insufficient automation efficiencies in place.

- Repetitive manual tasks still ruled the roost in the back office. For example, more than half of the Finance Executives surveyed felt that Accounts Payable and Accounts Receivable functions were the most manual, repetitive, and

time-consuming activities. - More than 60% of the executives surveyed stated that their teams spent more than six hours each week in wasted documentation-centric manual tasks such as seeking approvals, following up with vendors, and communicating with internal and external stakeholders.

- Approximately 50% of the executives surveyed disclosed there was no usage of artificial intelligence or advanced automation in the back office today, and close to 40% of the executives had a desire to introduce advanced technologies such as artificial intelligence, predictive analytics, and intelligent automation into the back office over the next 12 months.

Despite people working remotely and more hybrid work style structures in place over the last 12 months, Finance Departments have not transformed digitally as aggressively as one would have expected. While collaboration tools such as Zoom, Microsoft Teams, and Slack have shown a significant increase in the back office, the digitization of workflows and business processes are still laggards, and manual tasks are still abundant in the back office. As a result, finance teams were still burdened with repetitive tasks such as journal entry creation and review, coding reclassifications, and intercompany reconciliations, which were still massively time-consuming and error-prone.

This development is not a surprise, given how operations in accounts payable and accounts receivable are executed. For example, many of these areas require individual follow-ups with customers and vendors and parsing and extracting insights from unstructured documents such as invoices, contracts, and tax forms.

Furthermore, most of the back-office functions lack predictive analytical insights to assess risks while also missing automated algorithmic analytical calculation of key performance indicators to monitor business outcomes.

Change in the back office is forthcoming. The workplace of the future is digital. As identified in the executives we surveyed, Finance teams are looking for the means to become more efficient and more predictive in how work gets done in their domain. As a result, advanced technologies such as intelligent process automation, machine learning, natural language processing, and predictive forecasting are slowly showing up in the back office.

Over the next decade, four in five business processes will be executed digitally, with intelligent software at the heart of business process execution. Human oversight and governance will provide the necessary guardrails to ensure accurate business outcomes.

At Auditoria, our singular focus is the modernization and acceleration of the finance back-office. With a technology foundation based on Artificial intelligence, Cognitive process automation, Bots trained in Finance and Accounting, and the power of the Cloud and APIs, we empower finance teams to transform their operations into an autonomous future.

That future is closer than ever before, and I can’t wait to see how enterprises march on the journey to true autonomy in the back office.